Frequently Asked Questions

General Questions

Add your damages as you normally would so the damages are considered when the case is heard. Use the Liability Arguments to explain your position so the arbitrator understands your position.

GAP insurance is not recoverable because it is not for damages incurred in the loss. GAP coverage is payment due to an excess amount owed on a loan between the loaner and loanee. Even though GAP insurance is paid when a vehicle is a Total Loss, it is not damages that would be owed by a negligent tortfeasor who is only obligated to reimburse for the value of the vehicle.

Yes. Per Rule 2-4, if a Responding Party asserts denial of coverage, it must also submit a copy of its denial of coverage letter to the person seeking the coverage under the policy. If a denial of coverage letter to the proper party is submitted, the party will be placed out of jurisdiction. If no such letter is submitted, or the submitted letter is not to the appropriate person (i.e. letter is directed to named insured, not the person driving the vehicle, or to the Recovering Party advising them that coverage is being denied), the case will proceed to hearing wherein the denial of coverage position will be ruled on by the arbitrator. Another example could be where the Responding Party's position is based on the theft of its insured's vehicle. If the thief is unknown, the Responding Party will be unable to send a denial of coverage letter. This type of case will also proceed to hearing wherein the arbitrator will consider and rule on the defense of theft.

Yes, Total Recovery Solution® (TRS) does not block a filing, as there are instances where the late filing may be permissible. For example, under Rule 1-2, if a matter is in litigation and it is determined that all parties are represented by signatory companies, arbitration must be filed even if the statute of limitations has expired. It must be noted, though, that arbitration must be filed within 60 days of dismissal, or the Responding Party will be free to assert the delay as a jurisdictional exclusion.

Yes, there is an option to add a Responding Party when completing your response.

No, the arbitration agreements administered by AF are available only to insurers, self-insureds, or commercial insureds with large retentions/deductibles, not individuals - even if they should wish to participate. Their participation is excluded under the individual agreements.

A video file may be uploaded and attached to a filing.

If a party wishes to have video evidence viewed by the arbitrator, it must declare the tape, DVD, etc. as evidence. The member must also request a personal appearance. AF will contact the member representative to schedule a videoconference for the arbitrator to view the declared evidence.

In the event a member is unable to participate or share evidence via videoconferencing, AF will make arrangements with the member to provide the evidence to be viewed by an arbitrator, or the member may present the video evidence in person and must arrange for equipment to be available to present the evidence to the arbitrator.

In the case of audio evidence (such as recorded statements), AF requires the written transcript of the recording to be declared and provided as evidence for the arbitrator to view.

If a party wishes to have video evidence viewed by the arbitrator, it must declare the tape, DVD, etc. as evidence. The member must also request a personal appearance. AF will contact the member representative to schedule a videoconference for the arbitrator to view the declared evidence.

In the event a member is unable to participate or share evidence via videoconferencing, AF will make arrangements with the member to provide the evidence to be viewed by an arbitrator, or the member may present the video evidence in person and must arrange for equipment to be available to present the evidence to the arbitrator.

In the case of audio evidence (such as recorded statements), AF requires the written transcript of the recording to be declared and provided as evidence for the arbitrator to view.

Yes, video evidence such as dash cam or security videos can be submitted in the TRS platform.

- The file size cannot exceed 40MB.

- Acceptable file types are .mov, .wmv, .avi, .mp4, and .vob.

- All submitted video file types are converted to .mp4 format to eliminate any compatibility issues for the arbitrator.

- Bookmarking may be used on lengthy videos to indicate points of interest to the arbitrator.

- Examples of appropriate video evidence include: dash cam video of accident, security video showing accident, and video of scene.

- Links to external websites like YouTube as evidence are not permitted. AF and our member companies whose arbitrators hear cases remotely, prohibit access to external links as part of its IT security policy to prevent the spread of viruses, malware, etc.

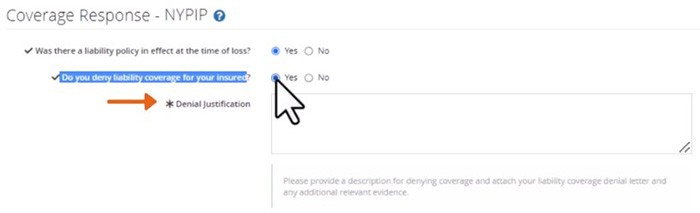

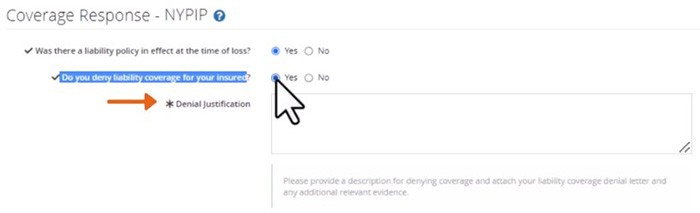

There are two coverage questions for the Responding Party to answer: "A liability policy was in effect at the time of loss" and "has coverage been denied for this claim."

For the first question, the Respondent will check "Yes" if the listed Insured, as identified by the Recovering Party, is an insured under a liability policy or is self-insured for liability. Check "No" if the listed Insured is not insured under a liability policy, the policy expired, the insured has collision coverage only (no liability coverage), or the listed self-insured has liability coverage with a carrier. If the Responding Party answers "No" to the first question, i.e. no liability policy in effect or policy expired prior to loss, the Responding Party will be placed out of jurisdiction. If this is the only Responding Party, the filing will be closed/withdrawn

If the Respondent answers "Yes" to the first question, it must then answer the second. If it answers “Yes” that coverage has been denied to the party seeking coverage for the loss in dispute, it must submit a copy of the denial letter to that party as evidence. If submitted, the party will be placed Out of Jurisdiction (per Article Second (e)). If a denial letter is not submitted, the case will proceed to hearing wherein the coverage defense will be considered by the arbitrator(s).

For the first question, the Respondent will check "Yes" if the listed Insured, as identified by the Recovering Party, is an insured under a liability policy or is self-insured for liability. Check "No" if the listed Insured is not insured under a liability policy, the policy expired, the insured has collision coverage only (no liability coverage), or the listed self-insured has liability coverage with a carrier. If the Responding Party answers "No" to the first question, i.e. no liability policy in effect or policy expired prior to loss, the Responding Party will be placed out of jurisdiction. If this is the only Responding Party, the filing will be closed/withdrawn

If the Respondent answers "Yes" to the first question, it must then answer the second. If it answers “Yes” that coverage has been denied to the party seeking coverage for the loss in dispute, it must submit a copy of the denial letter to that party as evidence. If submitted, the party will be placed Out of Jurisdiction (per Article Second (e)). If a denial letter is not submitted, the case will proceed to hearing wherein the coverage defense will be considered by the arbitrator(s).

The Dispute Damages tab must be used to dispute the amount of damages sought by the filing company. Damage arguments in any other section will not be considered by the arbitrator. Also, when disputing damages, you must state the specific damages being disputed and the disputed amounts. Simply stating "All damages are disputed" will not yield a favorable result. Lastly, if no entry is made in the Dispute Damages tab, damages are not at issue.

If the unnamed party is a signatory, you will add them as a Responding Party. You will present your liability position in your Liability Arguments.

If the unnamed party is not a signatory, you can secure its consent to participate in the arbitration and then add it as a Responding Party. You may need to contact AF to have a non-signatory company code created. Alternatively, you may simply present your liability position in your Liability Arguments and argue the unnamed party’s negligence. In this scenario, the Recovering Party may withdraw its filing if it wishes to pursue all parties outside arbitration. If the filing is not withdrawn, the arbitrator(s) will apportion liability and award damages, if applicable, against the named Responding Party. The Filing Party is barred from pursuing further recovery.

If the unnamed party is not a signatory, you can secure its consent to participate in the arbitration and then add it as a Responding Party. You may need to contact AF to have a non-signatory company code created. Alternatively, you may simply present your liability position in your Liability Arguments and argue the unnamed party’s negligence. In this scenario, the Recovering Party may withdraw its filing if it wishes to pursue all parties outside arbitration. If the filing is not withdrawn, the arbitrator(s) will apportion liability and award damages, if applicable, against the named Responding Party. The Filing Party is barred from pursuing further recovery.

If the Recovering Party asserts and supports that Joint and Several Liability applies to the filing, the arbitrator must follow local law and apply it in the arbitration. Local law controls the decisions, and the parties neither gain nor lose any rights in arbitration that they have in litigation.

Since the unnamed alleged tortfeasor is a phantom, arbitration would retain jurisdiction as the dispute is between two members. The named Responding Party will need to argue their respective liability position. The arbitrator(s) will apportion liability and award the Recovering Party what it is owed by the named Responding Party.

The damages being sought determine which forum is compulsory. If you are seeking recovery of auto damages, you must file in Auto; if you are seeking recovery of property damage, you must file in Property. The Respondent's liability coverage is irrelevant to the coverage under which the filing is submitted. A Responding Party can be an auto liability, homeowner's liability, general liability, products liability carrier, etc.

Yes, assuming the damages were paid under the auto coverage. The car seats would be listed under the “Personal Property” damage type.

If the Responding Party does not properly assert and support its policy limit coverage defense, or it fails to assert it at all, an amount in excess of the limits may be awarded. Rule 3-9 affords a Responding Party time after the decision publication to raise limits. If the policy limits are not raised/supported in the response or within the time frame allowed under Rule 3-9, then the excess award would be binding.

No. The deferment fee is assessed at the case level not the feature level, so only one fee is incurred.

There is nothing in the arbitration agreements or rules that compels a signatory to pay an adverse insured's claim. The Intercompany Arbitration Agreements bind the signatory companies to arbitrate disputes among themselves. The insured is not a party to the agreement. Article Third of the various agreements specifically states that an arbitration decision is "neither res judicata nor collateral estoppel to any other claim or suit arising out of the same accident, occurrence, or event" and "conclusive only of the issues in the matter submitted to the panel and only as to the parties to the arbitration." That said, the Adverse Party’s insured’s claim can be voluntarily paid.

A Responding Party may assert denial of coverage for this reason. Per Rule 2-4, if they submit a denial of coverage letter to the appropriate party advising them that coverage is being denied due to noncooperation or no notice, etc., the Responding Party will be placed Out of Jurisdiction. You would be free to pursue the 'uninsured' party directly. If no such letter is submitted, the case will proceed to a hearing. The arbitrator will consider the coverage defense, and any evidence submitted to support it. The arbitrator will either uphold or deny the defense. It should be noted that each state may have different "requirements" that a carrier must comply with to uphold such a defense.

Below are the states where intercompany arbitration is mandatory per state statute, and AF is specifically named as the administrator. The source is also provided; however, this is subject to change, and AF does not guarantee accuracy. For other states that mandate arbitration for disputes between insurers but do not specifically designate AF as the provider, arbitration would be compulsory if all parties are signatories to the Personal Injury Protection (PIP) arbitration agreement for the loss state; arbitration may also be filed with consent.

| State | Source | Forum |

| DC | § 31-2405 (i) | Auto Arbitration |

| DE | 21 Del. C. § 2118(g)(3) | Auto, PIP, Property, and Special (when claim involves DE registered motor vehicle) |

| KY | KRS 304.39-070 | PIP (Authority for PIP arbitration is given to KIAA, whose rules reflect that either the KIAA or AF may be selected for arbitration) |

| MD | Insurance Code 19-514 | Auto Arbitration |

| MN | § 65B.53 | PIP Arbitration |

| NY | § 65-4.11 of Regulation 68 | PIP Arbitration (Loss Transfer/Priority of Payment) |

| VA | § 38.2-2231 | Auto Arbitration |

An affirmative defense bears only the authority of an arbitrator on behalf of Arbitration Forums, Inc. to decide the dispute in arbitration. It has no bearing on the right of recovery in any other venue and is NOT a finding of no liability. It means only that Arbitration Forums has no authority over, or may not decide, the dispute.

Decisions may not be shared with insureds. Insureds do not understand the intercompany arbitration process that the membership has agreed to use to resolve their subrogation disputes. Further, the insured is not a party to the arbitration; only the interests of the signatory companies are involved. Signatories are free to handle their insured's claims as they deem appropriate, i.e., refund deductible, assess no liability, regardless of the arbitration decision.

No. Each forum includes a monetary limit for compulsory disputes. If the claim exceeds this amount, the matter is outside arbitration's jurisdiction. Arbitration might still be filed with written consent, or the Recovering Party may file arbitration for the compulsory limit and waive pursuit of the balance of the claim.

The distinction between proof of payment and proof of damages is important. Proof of payment is a must only when a Recovering Party, through its answer, asserts the Jurisdictional Exclusion of Subrogation Prohibited arguing the lack of a subrogatable claim. If not challenged, the presumption is the recovering insurer has made payment to its insured and a subrogation claim exists. A challenge should not simply be raised because the recovering party did not list proof of payment in its evidence listing. We don’t want to require the submission of unnecessary documentation. While it is not a requirement to submit proof of payment to prove damages, we recommend it be included in the evidence. Many arbitrators find it useful to verify if the Recovering Party has listed its damage claim correctly (not included its deductible twice, deducted its salvage return). It is also of particular benefit when there are prior partial payments. NOTE: The above does not apply to self-insured members that own and repair their vehicles, as there would be no payment to a repair facility.

KRS 304.39-070 gives insurers two options for resolving disputes: (1) joining as a party in an action that may be commenced by the person suffering the injury, or (2) filing intercompany arbitration. If an insurer opts (1), Rule 1-2 cannot be enforced; the statute takes precedence. This applies specifically to Kentucky PIP claims.

Kentucky statutory authority for PIP arbitration is given to KIAA whose rules reflect that either the KIAA or AF may be selected for arbitration.

No, but it is strongly recommended to ensure optimal recovery. This is especially true when a Responding Party has policy limits, and there are multiple exposures.

When you file, list your correct company code. The company code listed is used for billing purposes (i.e., filing fee, reschedule fee). When you are the Responding Party, correct your company when responding, if the Recovering Party has listed the incorrect subsidiary. Indicating the correct company when filing and responding eliminates any billing errors.

Yes, since you are seeking recovery for auto damages. The Auto forum is compulsory if the car wash’s liability insurer is a signatory. The type of damages sought determines which forum is compulsory, not the type of coverage afforded by the Responding Party. A Responding Party can be an auto liability, homeowner's liability, general liability, products liability carrier, etc. So, if the carrier is a signatory to Auto, arbitration is compulsory.

Yes, especially when liability is accepted, and the only disputed issue is damages. The Responding Party is the party that determines the issue(s) to be decided by the arbitrator. By entering a percentage of liability in the "I admit ____% liability" field, the Responding Party is advising the arbitrator that it concedes this amount of liability. The arbitrator can find the Responding Party more liable than it admitted but not less. Also, an offer is not a concession of liability. Prior negotiation correspondence between the parties can be submitted to support a liability theory, but it does not trigger whether liability is conceded. Rather, it is the Responding Party’s answer to the arbitration filing and what is entered in the "I admit ____% liability" field.

To document a denial of coverage, a denial letter must be directly addressed to the entity for whom coverage is denied (or the party seeking coverage) informing him of the denial (not always the Named Insured). A letter to another entity (i.e., any third party with a liability claim/action) regarding the denial is not sufficient for purposes of Rule 2-4. This includes correspondence that "copies" the entity for whom coverage is denied.

- Rule 4-2 allows AF to amend or void a decision if a clerical or jurisdictional error was made by the arbitrator or AF.

- Rule 3-9 allows AF to amend or void a decision for certain coverage defenses (no liability policy in effect on loss date, coverage denied, policy limits, etc.).

- Rule 2-12 allows a party to appeal a decision (Property and Special forums only).

The Filing Party has a choice to arbitrate against only the signatory party or file an action for recovery in a court against all negligent parties. If the Recovering Party chooses to arbitrate the dispute, it may NOT later file another action in court against the non-signatory. By choosing to pursue recovery via arbitration, the Recovering Party waives any right to pursue other parties separately outside of arbitration's jurisdiction.

A deferment is a one-year postponement of a hearing due to the existence of a companion claim or suit that may impact the arbitration. A deferment is not to be requested simply to get more time to prepare/submit a response. When considering whether to uphold a deferment request, the arbitrator will look at what effect the arbitration hearing will have on the companion claim/suit and vice versa. Since the arbitration decision is neither res judicata nor collateral estoppel, it, in itself, should have no effect on the companion claim/suit. Some reasons a deferment may be warranted include policy limits (including combined single-limit policy), discovery still in progress (results of which will be used in arbitration as well as litigation), and active fraud investigations. In many instances, when you have Auto and PIP or Med Pay companion claims, the arbitrator may agree to defer the PIP or Med Pay (for the above reasons) but not the Auto (unless there is a single-limit policy that would affect both claims). In closing, if you request a one-year deferment, you must effectively justify and support the request (deferment justification section), so the arbitrator understands why the companion claim/suit must be resolved first.

An arbitrator's decision must always be based solely on the evidence that is submitted. In cases where conflicting versions of an accident/loss are presented (i.e., conflicting insured versions of a motor vehicle accident), and no other evidence corroborates either insured's version, determining liability will most likely be impossible. An exception would be where the Recovering Party is an innocent party (i.e., parked or legally stopped vehicle) seeking recovery from multiple Responding Parties whose accident caused their damages. In these cases, while the specific liability percentage of the respective Responding Parties may not be determined, the Recovering Party has proven that its damages were the result of the accident, and an award may be apportioned equally amongst the Responding Parties.

- Create a Word document titled “Video Evidence.”

- While you complete the filing or response, select the “Video Evidence” evidence type and attach the Word document.

- Select the “Personal Appearance” option.

- AF will schedule a personal appearance hearing, so you can share the video with the arbitrator.

- Use the “Add Deferment” option in the Case Actions drop-down menu. We recommend this action be taken before submitting the filing or response. The deferment will be automatically granted. An Adverse Party may challenge the deferment if it believes the delay is not warranted. If challenged, the deferment will be ruled on by an arbitrator. If the request is upheld, the case will be deferred for one year from the date of filing. If the request is denied, the parties will be prompted to complete their filing or response.

- For deferred cases, the case status will automatically change from "Deferred" to "Scheduled Hearing" 120 days before the current deferment expires, and a notification is sent to the parties. At this time, a new deferment can be added if needed.

Rule 5-2 provides the process to follow to secure payment of an award. The rule also contains language that permits the Filing Party to seek reimbursement for any legal expenses, costs, etc., incurred should litigation have to be filed to enforce payment.

The entry in the "I admit ____% liability" field takes precedence over any liability arguments made in the Responding Party's contentions in most cases. For example, in cases involving a single impact, if the Responding Party enters "100%" in this field but also makes liability arguments in its contentions, the arbitrator's liability decision will be controlled by the 100 percent liability admission. (If "0%" is entered in this field but no liability arguments are made, the arbitrator is free to deem that liability is not at issue and resolve any damages disputed.) In cases involving multiple impacts where the Responding Party may be admitting 100 percent liability for the Recovering Party’s rear damages only, the arbitrator will have the discretion to rule on the disputed front damages.

There is a specific Jurisdictional Exclusion listed in the Jurisdictional Exclusion drop-down menu.

No, the date of the loss is not controlling. What controls compulsory jurisdiction is the status of the claim on the signatory effective date. If a pending claim meets the provisions of Article First, it is subject to compulsory arbitration, regardless of the accident date. The keyword is pending. Pending is synonymous, from the viewpoint of arbitration, with active claims. Closed claims are excluded, as are claims that have been abandoned prior to a company's decision to participate in arbitration.

Legal fees may be recovered for one of two reasons. A party may be entitled to recover attorney fees if a case is removed from arbitration because of an objection to jurisdiction (affirmative defense) raised by the Responding Party, it is discovered that it was properly placed in arbitration, and the Filing Party refiles the case (Rule 2-8). Legal fees may also be recovered in Special Arbitration. For more details, please refer to Chapter 16 in AF's Reference Guide.

Cases are administered in adherence to the rules in effect on the date of filing.

The only software you will need to access our Web products is Adobe Acrobat Reader 7.0 or higher, which can be downloaded for free from Adobe.

Please note, if you have a pop-up blocker installed, you must configure it to allow pop-ups from the arbfile.org domain. Failure to do so will cause problems with various functions within AF systems, e.g., online help, PDF generation, etc.

Please note, if you have a pop-up blocker installed, you must configure it to allow pop-ups from the arbfile.org domain. Failure to do so will cause problems with various functions within AF systems, e.g., online help, PDF generation, etc.

Product-Specific Questions

Yes, anytime during the negotiation process the Demander can move the case to arbitration if a liability and/or damages settlement cannot be reached.

No, E-Subro Hub members agree to issue and receive demands through the system. This ensures the members receive the full benefit of E-Subro Hub.

No, AF is a not-for-profit organization that exists to serve the industry. E-Subro Hub is offered to AF's members at no cost.

- E-Subro Hub members must have an individual in place to handle the routing of new inbound demands. The routing role, while very straightforward, is critical, as all new inbound demands need to be assigned to the correct adjuster or team owning the file. Keep in mind, demands received through E-Subro Hub are demands that would have formerly arrived via mail or fax. Receiving them electronically is more efficient and reduces costs related to mail handling and scanning the demand package into your claim system.

- NOTE: When explaining the routing role to a prospective member, it is important to point out that routing demands is a clerical role typically handled by someone who is already in a clerical role for the company.

In the current system configuration, clicking "Accept" confirms you are accepting Liability and Damages at the current negotiation and this action will be a matter of record in the demand activity log. Should arbitration be filed to recover an additional balance, record of having accepted an offer can be submitted as evidence for consideration by the arbitrator.

Yes, an authorized officer of the company must sign the agreement. Upon completion of the agreement, please forward a signed copy to the attention of membership@arbfile.org or send to:

Arbitration Forums, Inc.

Attn: Membership Services

3820 Northdale Boulevard, Suite 115

Tampa, Florida 33624

Arbitration Forums, Inc.

Attn: Membership Services

3820 Northdale Boulevard, Suite 115

Tampa, Florida 33624

- Subrogation-related expenses such as mailing, faxing, printing, and copying are eliminated.

- All supporting documentation is sent electronically.

- Unproductive phone calls (inbound and outbound) are reduced, as members can negotiate and share information electronically.

- Cycle time (demand issued to closed) can be reduced by as much as 40%.

- Demands are received electronically, so there is no need to scan a demand package into the claim system.

- Members can interface electronically through E-Subro Hub, eliminating many unnecessary phone calls, freeing up adjusters' time so they can focus on their own policyholders.

- The documents that are included with a demand are all converted to PDFs and are typically original-quality documents. This makes reviewing an inbound subrogation claim much easier.

Tutorials and Instructional Aids can be found on the E-Subro Hub Training Resources page. In addition, we offer training webinars--one dedicated to issuing a demand and another dedicated to responding to a demand. Please take a look at our Webinars for the course schedule.

Program-Specific Questions

Yes. Section 2118(g)(3) references "the Wilmington Auto Accident Reparation Arbitration Committee or its successors." The Personal Injury Protection Arbitration Agreement was previously titled "Automobile Accident Reparations Arbitration Agreement," and arbitration filings were heard by member arbitrators that comprised AF’s Wilmington Committee.

No. The insurance coverages required by Section 2118 (and for which the mandatory arbitration provisions relate) apply to vehicles required to be registered in the State of Delaware.

Yes. Del Code, Title 18, Section 2118(g)(3) states, "Disputes among insurers as to liability or amounts paid pursuant to paragraphs (a)(1)-(4) of this section shall be arbitrated by the Wilmington Auto Accident Reparation Arbitration Committee or its successors."

Yes. Arbitration Forums, Inc. only has jurisdiction over mandatory arbitrations between insurance companies. The DE Department of Insurance has a separate arbitration process for disputes that involve self-insurers. Section 2118(g)(3) states, "Any disputes arising between an insurer or insurers and a self-insurer or self-insurers shall be submitted to arbitration which shall be conducted by the Commissioner in the same manner as the arbitration of claims provided for in subsection (j) of this section."

This said, if a self-insured is signatory to the Auto, PIP, Property, or Special Arbitration Agreement, or they consent to arbitrate a matter using one of the forums administered by AF, the matter can be filed with AF.

This said, if a self-insured is signatory to the Auto, PIP, Property, or Special Arbitration Agreement, or they consent to arbitrate a matter using one of the forums administered by AF, the matter can be filed with AF.

The Auto, PIP, Property, and Special forums are mandatory forums for claims arising out of a motor vehicle accident involving vehicles registered in DE.

21 Del. C. 2118(g)(3) references "amounts paid pursuant to paragraphs (a)(1)-(4) of this section…."

Paragraph (a)(1): "Indemnity from legal liability for bodily injury, death or property damage arising out of ownership, maintenance or use of the vehicle to the limit, exclusive of interest and costs, of at least the limits prescribed by the Financial Responsibility Law of this State." Disputes arising from these claims are resolved through the Special Arbitration forum.

Paragraph (a)(2): "Compensation to injured persons for reasonable and necessary expenses incurred within 2 years from the date of the accident…" Disputes arising from these claims are resolved through the PIP forum.

Paragraph(a)(3): "Compensation for damage to property arising as a result of an accident involving the motor vehicle, other than damage to a motor vehicle, aircraft, watercraft, self-propelled mobile equipment and any property in or upon any of the aforementioned." Disputes arising from these claims are resolved through the Property forum.

Paragraph (a)(4): "Compensation for damage to the insured motor vehicle." Disputes arising from these claims are resolved through the Auto forum.

21 Del. C. 2118(g)(3) references "amounts paid pursuant to paragraphs (a)(1)-(4) of this section…."

Paragraph (a)(1): "Indemnity from legal liability for bodily injury, death or property damage arising out of ownership, maintenance or use of the vehicle to the limit, exclusive of interest and costs, of at least the limits prescribed by the Financial Responsibility Law of this State." Disputes arising from these claims are resolved through the Special Arbitration forum.

Paragraph (a)(2): "Compensation to injured persons for reasonable and necessary expenses incurred within 2 years from the date of the accident…" Disputes arising from these claims are resolved through the PIP forum.

Paragraph(a)(3): "Compensation for damage to property arising as a result of an accident involving the motor vehicle, other than damage to a motor vehicle, aircraft, watercraft, self-propelled mobile equipment and any property in or upon any of the aforementioned." Disputes arising from these claims are resolved through the Property forum.

Paragraph (a)(4): "Compensation for damage to the insured motor vehicle." Disputes arising from these claims are resolved through the Auto forum.

Questions specific to the Delaware Code can be submitted to doi-legal@state.de.us. For questions specific to the intercompany arbitration process, please submit a ticket in the member support portal or call 1-866-977-3434.

The term "unloaded" is not specifically defined. N.Y. Ins. Law § 5105(a) simply states the right to recover exists only if at least one of the motor vehicles involved is a motor vehicle weighing more than 6,500 pounds unloaded. This is commonly accepted to mean the actual weight of the vehicle excluding any item that is made part of the vehicle and excluding anything it was carrying or hauling. Regarding the evidence a party may submit to prove a vehicle's weight, the various accepted proof of unloaded weight includes but is not limited to: the vehicle VIN information from the Department of Motor Vehicles - as it provides the unloaded weight as opposed to the plate information which may be the gross maximum vehicle weight; a Certificate of Title or Certificate of Origin; a weight certificate from an official weighing station; Red Book or Blue Book information.

No. Per a NYSID Office of General Counsel opinion dated July 24, 2006, an insurer may not combine the weight of the motor vehicle and a trailer in order to qualify for the 6,500 pound limit requirement, which would allow transfer of loss to the insurer of the at-fault vehicle.

A vehicle for hire is a motor vehicle "used principally for the transportation of persons or property for hire" within the meaning of N.Y. Ins. Law § 5105(a) (McKinney 2000). This includes vehicles hired to transport people, such as taxis and buses, and vehicles hired to transport property, such as a tow truck. Rental U-Haul trucks are not included. See NYSID Office of General Counsel opinion dated May 2, 2001.

No. Per a NYSID Office of General Counsel opinion dated May 2, 2001, such a motor vehicle is not a motor vehicle "used principally for the transportation of persons or property for hire" within the meaning of N.Y. Ins. Law § 5105(a) (McKinney 2000), notwithstanding the fact that the owner charges its customers a fee for the delivery.

N.Y. Insurance Law § 5105 (a) provides that a PIP carrier or Workers' Compensation carrier may recover against a responsible party provided one of the motor vehicles involved in the accident weighs over 6,500 pounds unloaded or is a vehicle for hire. Involved means "part of or included in the accident" so the vehicle that is over 6,500 pounds or a vehicle for hire need not be the applicant or the respondent (Travelers Property V Allstate, 670 N.Y.S.2d. 959 (1998)). If the filing party asserts that an involved vehicle weighed more than 6,500 pounds or is a vehicle for hire (i.e. a taxi cab cut off one vehicle causing it to strike another vehicle), or the responding company asserts an affirmative defense objecting to jurisdiction on the grounds that no involved vehicle weighed more than 6,500 pounds or is a vehicle for hire, the arbitrator will render a decision on this issue based on the evidence submitted to support the respective contentions.

A Workers' Compensation provider cannot be a responding company in the mandatory No-Fault Inter Company Arbitration program (NY PIP). New York State Insurance Law Section 65.15 (1)(n)(viii) of Regulation 68 indicates that if a claimant is eligible for workers' compensation then said compensation provider shall serve as the sole provider of benefits. A Workers' Compensation provider may be a recovering company for Loss Transfer and seek recovery of its payments.

Yes, per the NYSID Office of General Counsel opinion dated September 9, 2009, an entity that has, pursuant to the New York Vehicle & Traffic Law ("VTL"), registered the motor vehicle with proper proof of financial security, that indicates that the entity is self-insured with respect to the vehicle, is the appropriate party to a loss transfer inter-company arbitration if the amount at issue wholly falls within the retention amount. If arbitration is filed against a liability insurer, the insurer would be free to assert a jurisdictional exclusion (Subrogation Prohibited) and submit evidence that proves the motor vehicle is registered as self-insured. If the motor vehicle is not registered as self-insured, then the liability insurer is the appropriate party to the arbitration. (Liability deductibles or policy limits do not apply.)

The Motor Vehicle Accident Indemnification Corporation (MVAIC) was established to pay bodily injury damages and no-fault benefits to "covered" victims of motor vehicle accidents caused by uninsured motorists. Visit www.mvaic.com for more information.

The following information regarding policy cancellations in New York was provided by MVAIC:

Policy cancellations should be in STRICT compliance with Vehicle and Traffic Law 313.

For assigned risk policies, the notice should contain the "the right to review phrase".

Reference: Vehicle and Traffic Law 313, Part 34 Motor Vehicle Liability Insurance Reporting New York Automobile Insurance Plan Manual.

NY Policy Cancellation by Premium Finance Company Requirements:

Reference: Banking Law 576

Out-of-State cancellation notice should be in compliance with each state regulation

The following information regarding policy cancellations in New York was provided by MVAIC:

Policy cancellations should be in STRICT compliance with Vehicle and Traffic Law 313.

- DMV filing: 30 days following the effective date of cancellation. The proof of DMV filing, if not reflected in the DMV Expansion, should come from the Department of Motor Vehicle, and not from the Insurance carriers' computer print-outs.

- Mailing requirements: Should have a postal stamp. Should be mailed 15 days before the cancellation for non-payment of premium; 20 days before for policy cancellation for other than non-payment of premium.

- There should be correct financial security language.

For assigned risk policies, the notice should contain the "the right to review phrase".

Reference: Vehicle and Traffic Law 313, Part 34 Motor Vehicle Liability Insurance Reporting New York Automobile Insurance Plan Manual.

NY Policy Cancellation by Premium Finance Company Requirements:

- 10-Days Notice of Intent to Cancel - with stamped proof of mailing

- Cancellation notice - with stamped proof of mailing

Reference: Banking Law 576

Out-of-State cancellation notice should be in compliance with each state regulation

- Mailing requirements

- Filing with DMV or Registry of Motor Vehicle

The New York Motor Vehicle No-Fault Insurance Law cover letter (NYS Form NF-1A Rev 1/2004) specifically states: "b. 80% of lost earnings up to a maximum monthly payment of $2,000 for up to three years following the date of the accident."

The only other circumstance would be where the responding company does not assert the jurisdictional exclusion (Subrogation Prohibited). Otherwise, arbitration is not mandatory for claims involving carriers or self-insureds that do not do business in New York (see NYSID Office of General Counsel opinion dated March 31, 2004). It should also be noted that following the enactment of the No-Fault laws, a number of non-resident insurers, who do not do business in New York State, executed waivers with the New York State Department of Motor Vehicles, subjecting themselves to New York law and jurisdiction should one of their vehicles come into New York State and be involved in an accident in this state. To learn if an out-of-state insurance company has executed and filed a Power of Attorney with the New York Department of Motor Vehicles (DMV), an email request should be made directly to dmv.sm.iiesmail@dmv.ny.gov.

For insurers, a printout from the NYDFS Web site that lists those insurers that are authorized to write in NY. On the NYDFS Web site, click the drop-down arrow in the third row for "Company Name from the List" to display the full listing of licensed companies.

For a self-insured, any written documentation from a representative of the company, affirming it does not do business in New York, should be accepted in good faith, i.e., an affidavit from a manager or officer of the corporation.

For a self-insured, any written documentation from a representative of the company, affirming it does not do business in New York, should be accepted in good faith, i.e., an affidavit from a manager or officer of the corporation.

- No, for loss transfer disputes. Yes, for priority of payments disputes.

- Under the appellate division case of Hunter v OOIDA 79AD 3rd 1 (2010), a loss transfer case involving an out-of-state accident cannot be heard in New York due to the wording of Section 5105 which creates that right only when the injured party could have made claim but for provisions of Article 51 of New York insurance law and the case qualifies (an involved vehicle weighs 6,500 lbs or more or is a vehicle for hire). In the case of an out-of-state accident, it is not Article 51 which bars suit as Article 51 has no extraterritorial effect. Therefore the terms of Article 51 do not bar suit even if the other state's laws bar suit. So the accident does not fall within the precise language of Section 5105.

- Priority of payments arbitration is allowed for an out of state accident based upon the ADDITIONAL provision of Section 5105 which requires Intercompany arbitration in a situation in which carriers dispute which coverage is primary. That arbitration does not come under the loss transfer arbitration restrictions. Therefore if two or more NY carriers have a dispute as to which is primary it must be heard in NY priority of payments arbitration.

- See also: the NYSID Office of General Counsel opinion dated April 30, 2003.

Yes, a court order or verdict can be res judicata/collateral estoppel, depending on the particulars of the court order and the information it contains.

A copy of the order deciding the motion for summary judgment or the verdict sheet after trial would be acceptable; an E-law printout would not be acceptable because it does not give details of the suit.

It is not improper to decide liability at 50% against both parties involved in an accident if this is what the evidence supports. What is improper is to render a liability determination of 50% against both parties involved in an accident when liability has not been established against either party - the evidence does not clearly prove the respective driver's negligence to be equal, or the evidence does not clearly prove liability against either party, i.e., all evidence is conflicting and neither party has proven which driver is the cause of the accident.

The burden of proof in intercompany arbitration is "preponderance of the evidence" (civil matters), not the threshold of "beyond a reasonable doubt" (criminal matters). This simply means that the recovering company does not need to provide indisputable proof, i.e., the only possible explanation of what happened, but only needs to show that its factual explanation is more likely true than any other alternative explanations. It also means that all possible alternative explanations need not be specifically ruled out in order for the recovering company to prevail. If the recovering company proves a prima facie case by a preponderance of evidence, you will then review the responding company's answer to determine whether comparative negligence should be applied. The responding company is the party that determines if liability is at issue. If the responding company does not answer, liability must still be proven by the filing party. If the responding party does answer and admits liability, the recovering company only has to prove damages. If a percentage of liability is admitted, you may not award less than that amount.

An Arbitrator has the authority to adjourn a hearing to request evidence that is listed (and implied to be presented) but is not available or for clarification of submitted evidence such as case law, opinions, and proof of damages.

A jurisdictional exclusion is an objection to jurisdiction that, if applicable, will remove the party or filing from arbitration's jurisdiction without a decision on the issues of liability or damages. The type of proof necessary to support a jurisdictional exclusion will vary depending on the exclusion that is asserted. For example, if the respondent asserts a denial of coverage, it must submit a copy of its denial of coverage letter to the party seeking coverage for the accident (i.e., alleged negligent party).

All decisions regarding liability and/or damages are final and binding. The only instance where arbitration can be re-filed after an arbitrator makes a decision would be if the decision was to uphold a jurisdictional exclusion causing the case to be closed for lacking jurisdiction (no decision on liability or damages has been made) and the impediment has been removed. For example, an arbitrator closes an initial filing due to the condition precedent was not satisfied (i.e., the Intercompany Reimbursement Notification was not sent to the Respondent prior to arbitration being filed). The recovering party can send the appropriate Notification to the responding party and then re-file should settlement not be reached (assuming the applicable Statute of Limitations has not lapsed in the interim).

While the rules are silent on this issue, a responding company may not name or add additional responding parties to an arbitration filing. The named responding company may only argue the respective liability of other parties in its liability arguments. The arbitrator will consider all the arguments made and evidence submitted and apportion the liability of the named parties, awarding the amount proven against the named responding companies.

No. Per the Intercompany Reimbursement Notification form only "Basic Benefits" are subject to mandatory arbitration under Section 5105 of the Insurance Law. Only by agreement of the parties can "Additional Benefits" be submitted. See Section 5102 Definitions for the definitions of (a) "Basic economic loss" (1) Medical, (2) Loss of earnings, (3) All other reasonable and necessary expenses. (This does not apply to Priority of Payment disputes.)

No. Per a NYSID Office of General Counsel opinion dated June 16, 2010 and an August 24, 2010 Circular Letter issued by the New York State Insurance Department, an automobile insurer or self-insurer may not offset recovering company's aggregate no-fault benefit limit for the payment of a HCRA surcharge. This applies retroactively regardless of when the surcharge was paid by the automobile insurer or self-insurer.

As a condition precedent to filing arbitration, the recovering company must send the "Inter-Company Reimbursement Notification Form" to the adverse party from which they are requesting reimbursement of its first-party benefits. No other documentation is "required" to be provided prior to arbitration being filed. That said, it is presumed the parties will exchange necessary documentation to facilitate settlement of the claim and submit a matter to inter-company arbitration only after negotiations fail.

There is no similar rule under the NY PIP/Loss Transfer intercompany arbitration procedures. If a responding company does not comply with an award, the recovering company has two options: File a complaint regarding the party's non-payment with the NYS Department of Financial Servies and/or file a motion to enforce the award with the Court. For cases filed in AF’s TRS application, a one-time courtesy Unpaid Award notification is available to send to the non-paying Responding party if the award has not been paid 30 days after the decision publication. The functionality may be found in the Case Overview > Decision Actions.

All arbitration decisions regarding liability and/or damages are final and binding. The only instance where litigation can be filed after an arbitrator makes a decision would be if the decision was to uphold an affirmative defense causing the case to be closed for lacking jurisdiction in inter-company arbitration (no decision on liability or damages is made). For example, an arbitrator closes an arbitration filing due to the affirmative defense that the respondent carrier has denied coverage for the loss to the alleged negligent party seeking coverage under its policy. The applicant would be free to pursue the uninsured driver outside of inter-company arbitration.

Yes. Per a NYSID Office of General Counsel opinion dated August 1, 2003. Because OBEL coverage is an element of basic economic loss and therefore a first party benefit, the insurer of an at-fault vehicle in excess of 6,500 pounds or for hire, is obligated under the statute to provide the full amount of first party benefits paid by the other No-Fault insurer under Section 5105(a) loss transfer, including instances where first party benefits paid include No-Fault OBEL coverage.

Per the New York Insurance Department, the recovery by the pedestrian's vehicle insurer is not based on which vehicle struck the pedestrian or which vehicle is at fault. Under the sources of mandatory personal injury protection benefits provisions of 11 NYCRR 65-3.12, first party benefits paid to the pedestrian would be recoverable from the insurers of vehicle A and vehicle B as both vehicles were being used or operated at the time of the collision. Further, 11 NYCRR 3.12 (e) provides in relevant part that:

"Any insurer paying first-party benefits shall be reimbursed by other insurers for their proportionate share of the costs of the claim and the allocated expenses of processing the claim, in accordance with the provisions entitled "Other coverage" contained in the section 65-1.1...and... "Other sources of first-party benefits" contained in subpart 65-2..."

Accordingly, as there are two sources of first-party benefits available in the above scenario presented, the pedestrian's vehicle insurer would recover 50% from the insurer of vehicle A and 50% from the insurer of vehicle B.

"Any insurer paying first-party benefits shall be reimbursed by other insurers for their proportionate share of the costs of the claim and the allocated expenses of processing the claim, in accordance with the provisions entitled "Other coverage" contained in the section 65-1.1...and... "Other sources of first-party benefits" contained in subpart 65-2..."

Accordingly, as there are two sources of first-party benefits available in the above scenario presented, the pedestrian's vehicle insurer would recover 50% from the insurer of vehicle A and 50% from the insurer of vehicle B.

Loss transfer may not be brought against the insurer of a motorcycle. The owner/operator/passenger of a motorcycle is NOT a covered party pursuant to Section 5103 of the Insurance Law. Section 5105 provides loss transfer only for accidents between "covered" parties. As an aside, arbitration may be filed against a motorcycle insurer under a priority of payments scenario. For example, if a motorcycle hits a pedestrian, the motorcycle must provide PIP to the pedestrian. If the pedestrian's carrier pays him/her PIP they can file a priority of payment claim against the motorcyclist's carrier. Or, if a car and a motorcycle collide and one strikes a pedestrian and one of them pays PIP to the pedestrian, they can seek priority of payment reimbursement pro rata against the other.

- Legal fees are not recoverable in loss transfer arbitration. They are an administrative expense, not a benefit.

- Workers compensation legal fees are recoverable in loss transfer arbitration because unlike PIP they are not an added expense to the paying carrier, they are deducted from the workers' compensation award payable to the injured party.

- Legal fees are recoverable in priority of payment arbitration when they have been incurred as a reasonable and necessary expense in the defense of a PIP denial by the Applicant.

Pursuant to Rule 2 Initiation of Arbitration (v) of the NY PIP Rules, the responding company must:

If these three requirements are met, the responding company will be deemed Out of Jurisdiction. This does not apply to cases filed by MVAIC.

- Select the appropriate option indicating that liability coverage has been denied for the claim in question.

- State the reason for the coverage denial.

- Attach a copy of the denial of liability coverage letter to the party seeking coverage for the loss (i.e., alleged negligent party).

If these three requirements are met, the responding company will be deemed Out of Jurisdiction. This does not apply to cases filed by MVAIC.

No, the issue of an insured's involvement is an issue of fact or liability, not coverage. The Respondent carrier has the duty to defend its insured (i.e., provide coverage). The liability argument of non-involvement is to be presented in the contentions and supported with evidence for the arbitrator's consideration (i.e., the insured's statement or a vehicle log confirming where the vehicle was when the loss occurred). The arbitrator's decision will be neither collateral estoppel nor res judicata to any litigation brought against the insured of the respondent. That said, if litigation is pending, a deferment may be requested.

Yes. Under Sec 227 of the Worker's Compensation Law which is the Disability Benefits Law, a carrier which pays disability can recover its disability payments in a case in which the tortfeasor is a covered person and the accident contains a qualifier as set forth in Sec 5105 of the Insurance Law. The reason is similar to that of a Worker's Comp carrier recovering lost wages-the disability payments are an offset to PIP under Article 51 of the Insurance Law and just as Workers Comp wages are recoverable, disability payments are-subject to their being a qualifier.

No. Although the Federal government vehicle may meet the criteria for "covered" and a qualifying vehicle may be present, the Federal Government may not be brought into a state mandated arbitration proceeding.

No. Additional PIP is not subject to loss transfer pursuant to Section 5105 of the Insurance Law which provides only for mandatory arbitration of basic no fault benefits. Special Arbitration may be used to recover APIP if all parties consent.

No, it is not required. General Municipality Law 50e does not apply and the Statute of Limitations is, as in all other cases, three years from each payment. The New York State Court of Appeals ruled in the case of City of Syracuse v. City of Utica that Article 51 of the Insurance Law is paramount in these cases and the provisions of General Municipality Law and Court of Claims Act requiring notices of claim and setting short statute of limitation do not apply to loss transfer arbitration proceedings.

No. E-law is one form of evidence, but it is not the only acceptable form that can be submitted. A party may submit e-law to support that litigation is still pending. However, the adverse party may submit other forms of evidence to support that the litigation is no longer pending. For example, a Stipulation of Dismissal may have been filed with the court that is not yet reflected in e-law. An arbitrator's decision on whether to grant a deferment, if challenged, will be based on the evidence that best proves the current state of the companion claim or suit.

No. Loss transfer proceedings entail a determination of comparative negligence among the accident participants. In New York, joint and several liability falls under N.Y.C.P.L.R. § 1601. The section specifically relates to situations in which a verdict or a decision is reached in a claim for personal injury. As PIP is separate and distinct from claims for personal injury, it is not applicable. Moreover, joint and several liability applies to situations in which a verdict has already been issued finding joint liability between several tort feasors. As such, a recovering company may not assert joint and several liability in New York Loss Transfer Arbitration. Rather, the recovering company should include all identified parties as Respondents to the arbitration filing for a determination of respective culpabilities.

Pursuant to a June 2016 court decision, it may not. In its decision, the court noted that Insurance Law 5101 pertains to health providers.

All appearances are via conference call. There are no in-person hearings. The intent to appear must be indicated where appropriate when submitting the filing or response. AF will send the call-in information as well as the date and time for the call.

Only one IRN is required for each feature filing that is to be heard.

- If additional payments are made after filing arbitration, but the filing is deferred, the recovering company need only send the original IRN to the responding company.

- If an initial filing is heard/closed, and a supplemental filing is to be submitted to recover additional payments, a new IRN must be sent to the responding company for the supplemental damages.

AF is proud to have served as the inter-company arbitration administrator since the program's inception in the early 1970's. Circular Letter No. 10 (2005) issued May 16, 2005, by the New York Department of Financial Services, reinforces AF's authority as administrator.

- Review the frequently asked questions on the New York State Department of Financial Services website.

- View the New York State Department of Financial Services Circular Letter No. 3, April 12, 2019.

- View the New York State Department of Financial Services Circular Letter No. 4, April 12, 2019.

That is a question the recovering company needs to decide, and it might be best to contact the New York Liquidation Bureau since the liquidation order likely would address claims against a carrier in liquidation. The standard language in every Liquidation Order provides the following relief: “All parties are permanently enjoined and restrained from interfering with the Liquidator or this proceeding, obtaining any preferences, judgments, attachments or other liens, making any levy against (Carrier), its assets or any part thereof, or commencing or prosecuting any action or proceedings against the carrier, the Superintendent as Liquidator of the Carrier, or the New York Liquidation Bureau, or their present or former employees, attorneys or agents, relating to this proceeding or the discharge of their duties under Insurance Law Article 74 and 76.”

The damages sought may include benefits paid under OBEL. The filing company must prove that the injured party meets the definition of an Eligible Injured Party on the responding company’s policy. (Eligibility requirements for the PIP endorsement can be found on page 4 of Regulation 68.) Additionally, there are times when an injured party may be eligible under the policy of multiple responding companies. If they are all New York policies, the damages will be split evenly. If one is an out-of-state policy, the damages would be pro-rated.

Pursuant to New York State Insurance Law §§5202(b) and 5221(b)(1) Motor Vehicle Accident Indemnification Corporation (“MVAIC”) is only authorized to provide PIP benefits to individuals with no available insurance, i.e., “qualified person.” Insurance Law §5105(a) only applies to insurers liable for the payment of first party benefits on behalf of a “covered person.” The availability of no-fault coverage would preclude responsibility for payments by MVAIC under Insurance Law §§5202(b) and 5221(b)(1). Thus, MVAIC can never be a responding company in a mandatory No-Fault Inter Company Arbitration (NY PIP). MVAIC may be a recovering company for Loss Transfer and seek recovery of payments made on behalf of a “qualified person.”

A decision may be appealed on a case when the Company Claim Amount is at least $10,000. The appeal process is described in Rule 2-12.

Yes, but only with their written consent. The nonmember's answer to a filing also implies consent and indicates an acceptance of a final and binding decision. A non-member who wishes to file should provide the consent of the member company with the filing. Once a party consents to arbitrate, the consent may not be withdrawn.

Yes, but only if you don’t assert policy limits, where provided, attach evidence to support the limit amount, and include any additional exposures, if applicable. This is typically done when responding to a filing but can also be submitted as a post-decision inquiry within 60 days of the decision publication date (Rule 3-9).

Yes, a company has the option to file a companion claim, so long as it arises from the same loss for the same line of coverage/coverage group (Property). The Property arbitration panel will hear all Property companion claims when the related feature is selected at the time of submission.

An email notification is sent as soon as the decision is published. All decisions are available from the blue ellipsis found on the TRS Worklist.

AF will assign arbitrator(s) based upon the Company Claim Amount using the following criteria:

- Under $15,000 - one arbitrator

- $15,000 and above - one arbitrator unless three are requested. A party requesting a three person panel will be charged a fee.

The filing company would have two options. First, they could re-file arbitration if/once reasonable accommodations for the inspection of the defective part were made as a result of the arbitrator's decision (since the objection to jurisdiction would be removed). If reasonable accommodations could not be made, i.e. the defective part is not available for inspection, then the filing company would be free to pursue the matter outside of arbitration. The rationale for this is that the Courts have more formal rules of evidence for these types of situations.

Yes, but only if you are looking for reimbursement for money paid to your insured for a claim arising out of the same loss. As responder, you must answer “Yes” to add damages and complete the counterclaim workflow by entering your itemized damage amounts.

There is no time limit to filing other than the Statute of Limitations if raised by a responding party. It is a good idea to file at least 120 days before the statute of limitations when possible. This leaves time for other action(s) if the responder raises a valid objection to jurisdiction.

- As a condition precedent to using the rules and regulations, the parties should attempt to settle before filing in Arbitration. However, at a minimum the correct and current claim representative's name and address, the insured name, and claim number of the adverse party must be provided.

- Confirm whether adverse carrier or self-insured is signatory to Property Arbitration Agreement.

These are considered one claim to be filed on one application and would be subject to a single forum limit of $100,000. If the aggregate amount of these payments exceeds the $100,000 compulsory limit, the filing party would need to be willing to limit their recovery to the forum limit, or both parties would need to consent to arbitrate the case. If the filing party were to file them separately, the responder could assert a jurisdictional exclusion that jurisdiction is lacking since the aggregate amount exceeds the compulsory limit.

Property Cases may be heard by AF staff arbitrators or member arbitrators from the signatory companies. All arbitrators who decide Property disputes have significant claims experience. Each member arbitrator must be recommended by their supervisor/manager and must be certified by AF confirming their claims knowledge and their understanding of Property Forum rules.

Subrogation claims based on either negligence or concurrent coverage involving homeowners, commercial property, inland marine coverage, and damage to vessels on navigable waters within the geographic limits of one state.

- The compulsory limit is $100,000.

- AF considers a claim and a counterclaim as separate claims.

- AF considers a claim and a companion claim for a different line of coverage as separate claims. As such, each claim has its own monetary limit.

Formal rules of evidence do not apply, so you may submit any materials that support your position, including expert reports, briefs of law, photographs, statements, etc.

The filing company pays the filing fee. View AF’s current filing fees.

- Eliminates the need for expensive and drawn out litigation to recover from negligent third party insurer or self insured.

- Simple and easy for an adjuster to use

- Decisions are made by qualified Claims professionals

- No formal rules of evidence apply

- Decisions are private

After a filing is submitted, you will see the Response Due Date or the status as Ready to Hear. The majority of filings are heard within 30 days of being submitted should you wish to set a diary.

Yes, the arbitrator(s) will provide an explanation for their decision and note the supporting evidence for that finding.

Yes, you may request a deferment in this forum. Per Rule 2-10, a deferment request by any party will be granted, unless challenged. An adverse party may challenge the request if it believes the delay is not warranted. If challenged, an arbitrator will consider the validity of the deferment request. If the deferment is allowed, the case will remain deferred for one year from the deferment request date. If the deferment is not allowed, the case will continue as not deferred.

Yes, with written consent or if the non-member implies consent when it submits an answer, unless the answer is an objection to AF's jurisdiction. The non-member's answer indicates an acceptance of a final and binding decision. However, it is recommended that you get written consent up front and submit a copy at the time of filing.

Yes, with written consent of the involved parties. You may submit cases to determine coverage disputes, apportion liability, allocate fault and/or determine contribution prior to settlement. Without written consent, there must always be a settlement with the injured party before filing Special Arbitration.

No, as long as the limit of liability is raised as a jurisdictional exclusion and supported by some form of evidence, in accordance with Rule 2-4. However, the other party may agree to accept your limits if they desire. Rule 3-9 also allows the possibility for post-decision relief.

Yes, a company can add additional signatories for alleged tortfeasors that the Recovering Party did not name. Your rationale for including them in the case will be outlined in your Contentions. If the alleged tortfeasor is not insured by a signatory member, you will argue their negligence in the Recovery Arguments.

Only companion claims that are compulsory in Special for damages resulting from the same accident, occurrence, event, or offense will be heard together if they have been submitted together.

You may file cases for reimbursement of payments under UMBI or UMPD coverage from the insurer for the responsible tortfeasor who was identified or acknowledged coverage after the payment. Disputes involving UIM coverage are not compulsory in Special Arbitration and may be heard only with consent or if the responding member answers without asserting the affirmative defense regarding jurisdiction.

Yes, you can seek recovery of legal fees in this forum. These fees consist of expenses directly related to the prosecution or defense of a lawsuit and must be in conjunction with the damages sought for the settlement. In other words, a party may not file for legal fees only.

Once the claim is settled (per the definition of settlement), claims relating to construction defect exposures could be filed in Special as either of the third- party liability compulsory disputes. Contribution among co-defendants disputes could be used for recovery of all or part of a third-party settlement from another negligent tortfeasor; concurrent coverage disputes could be used for recovery of all or part of loss or legal expense payments from another insurer who also provides coverage for the same insured.

No, the decision is conclusive only of the issues in the matter submitted to the arbitrator and only as to the parties to the arbitration. All matters concerning an arbitration proceeding are held in strict confidence.

Yes, if permitted in the applicable jurisdiction, recovery of workers’ compensation benefits from an alleged responsible third-party tortfeasor is permitted in this forum. No other dispute involving workers' compensation is compulsory in Special Arbitration.

No. An adverse party may contest the settlement amount.

Decisions are final and binding to all parties, however, any party may appeal a decision wherein the Total Settlement amount is $100,000 or more (Rule 2-12). This appeal must be brought to AF's attention within 30 days from the date of the publication of the decision.

Once a decision is entered into AF's system (published), all interested parties will be notified that it is available on our website.

If the Contribution Sought Amount or legal Fees Sought Amount is under $15,000, one (1) arbitrator will hear the case. If either of these amounts is $15,000 or more, any party may request a three-person panel.

Rule 1-3 makes a claim based on a "claimant." Therefore, if the injured person and the owner of the vehicle are the same claimant, the bodily injury and property can be filed together (one filing). If the injured person and the owner of the vehicle are different entities (claimants), they need to be filed separately (two filings).

- No, there are no counterclaims in Special Arbitration. The arbitrator will determine the apportionment of liability among the involved parties. The arbitrator will also apply that percentage to the total amount of the settlement to determine each party's contribution amount. Recovery for legal fees set forth in a company's written response will also be decided if these amounts are listed on the application.

- If another third-party claim arising from the same event was settled by another participating party for which liability should be apportioned, a separate Special case should be filed, referencing the original case number. The second case will be heard as a Companion to the original filing.

There is no time limit as long as a legal cause of action exists. AF follows the rules and guidelines of the local jurisdiction. However, the Recovering Party should file within 180 days from the date of settlement. Exceeding the 180 days allows an affirmative defense to be raised and allows an opposing party to try to show the delay has caused prejudice.

As a condition precedent to filing in Special Arbitration, all parties should conduct direct negotiations in an attempt to settle the claim. The condition precedent requires the filing party, at a minimum, to list the correct and current representative's name, address, insured name, and claim file number for all adverse parties.

Yes, Uninsured Motorist recovery is compulsory in Special. In most cases, all the other first-party reimbursement situations will fall within the jurisdiction of another AF program - subject to the rules and regulations of that forum.

No. Additional PIP is not subject to loss transfer pursuant to Section 5105 of the Insurance Law which provides only for mandatory arbitration of basic no fault benefits. Special Arbitration may be used to recover APIP if all parties consent.

Yes, as long as all tortfeasors who will participate in the arbitration have been released by the third party. If the statute of limitations has run or will have run, the case must be filed in arbitration within 60 days of the dismissal of the lawsuit.

- The alleged tortfeasor(s) must be a self-insured entity and/or an insured with a casualty insurance policy.

- One of the tortfeasors must contend others are legally liable for: (1) bodily injury or property damage, or (2) providing defense for the third party action.

- One or more of the insurers and/or self-insureds must have participated in the settlement of a claim with the third party.

- The insurers or self-insureds must be signatories (members) to the Special Arbitration Agreement. (Non-members may participate with consent.)

- All participating parties have a policy or self-insure casualty or property coverage for the same person, entity, or risk for the same triggering event.

- Either of the following conditions exists: (1) The insured is legally liable for a bodily injury or property damage claim and at least one of the insurers or self-insureds has settled the claim with the third party, or (2) The insured has suffered a loss or injury paid by at least one of the insurers or borne by the self-insured.

- The insurers or self-insured are signatories (members) to the Special Arbitration Agreement. (Non-members may participate with written consent.)

If the filing company's argument will be that the Responding Company's liability coverage is primary for third-party damages, this would be a concurrent coverage dispute filed in Special Arbitration (Article First b). If the filing company is seeking recovery of their first-party damages from the Responding Company due to renter's/driver's negligence or liability under the contract, this would be filed in the Auto Forum.

Concurrent coverage disputes under Article First (b) in Special are limited to those involving property or casualty insurance. PIP is obviously not property insurance and casualty insurance is an AF-defined term that specifies bodily injury, property damage, personal injury or advertising injury, as well as uninsured motorist. It doesn't apply to PIP. Also, the compulsory dispute in PIP is triggered by recovery rights, which is defined to be much broader than subrogation, and specifically includes reimbursement and indemnity - which essentially describe contribution because of concurrent coverage. Based on the above, PIP is the appropriate forum to resolve this kind of dispute.

All Special Arbitration cases are heard by arbitrators who are experienced claims professionals and have been certified under an Auto Liability and/or General Liability track. Our Special arbitrators consist of signatory members as well as AF staff employees.

Compulsory disputes include liability apportionment between alleged joint tortfeasors, concurrent coverage disputes for third-party damages, and subrogation of workers' compensation benefits paid by an insurer or a self-insured from an alleged tortfeasor after settlement. Other kinds of disputes may be heard with the consent of all parties.

- Compulsory arbitration is applicable to a maximum of $250,000 contribution sought per claim.

- Claims for separate parties arising out of the same accident, occurrence, or event are considered separate claims.

- AF considers a claim and a companion claim for a different line of coverage as separate claims. As such, each claim has its own monetary limit.

Concurrent coverage disputes filed in Special must be seeking contribution to the damages paid to a third party. These can include a driver using another party’s vehicle or rental vehicle, damages caused by construction defects over multiple policy periods (time on risk), and other contractor or subcontractor liability disputes as additional insured/contract liability in which one party settled the innocent party’s claim and seeks recovery from the other.

All filing can be done online at www.arbfile.org.

The Recovering Party pays the fee; members pay $42, and non-members pay $84.

- Cases are settled more quickly, capping the exposure to the third party.

- Minimizes the need for expensive and drawn out litigation

- Simple and easy for an adjuster to use

- Certified claims professionals make the decision, not lay jurors.

If your company has elected to receive notices, you will be notified as each party completes their submission or their window for submission expires. The case is deemed "ready to hear” once all actions are taken and is available to be pulled by the arbitrator.

Yes, the arbitrator will provide comments explaining the basis for his/her decision.

No, settlement of the claim will not prejudice the case of any participating party.

Website-Related Questions

We have created a guide to help existing users access their account using our Identity Management system.

Your company has a designated security administrator who can create user login accounts with proper privileges.

Every individual user should be set up with their own user ID to access the AF website. Shared logins are prohibited. For example, one user’s user ID and password being used by people other than the original authenticated user is prohibited. For more information, please refer to AF's Terms of Use.

No, we set up TPAs with their own company code and dedicated security administrator. Should you wish to have a TPA file on your behalf, both a TPA Consent Form and a TPA Access Agreement must be completed and returned to membership@arbfile.org or

Arbitration Forums, Inc.

Attn: Membership Services

3820 Northdale Boulevard, Suite 115

Tampa, Florida 33624

The TPA Consent Form must be signed and submitted by the member company to authorize AF to web-enable a third-party administrator and grant access to the member’s cases on AF’s website.

The TPA Access Agreement must be signed and submitted by the TPA company agreeing to access the Services provided by AF, as limited by the Terms of Use and only on behalf of each member expressly granting the TPA authority in writing.

Both the consent form and access agreement MUST be signed by a corporate officer, senior level executive, or an individual that has the authority to bind the organization to a nationwide contract and not be case specific. If signed electronically, the digital signature(s) must be backed by a digital certificate (e.g., Adobe Sign or DocuSign).

Arbitration Forums, Inc.

Attn: Membership Services

3820 Northdale Boulevard, Suite 115

Tampa, Florida 33624